Artificial intelligence in auto claims management- Arnie AI Repair Estimator

Ready for intelligent repair estimation?

The challenge

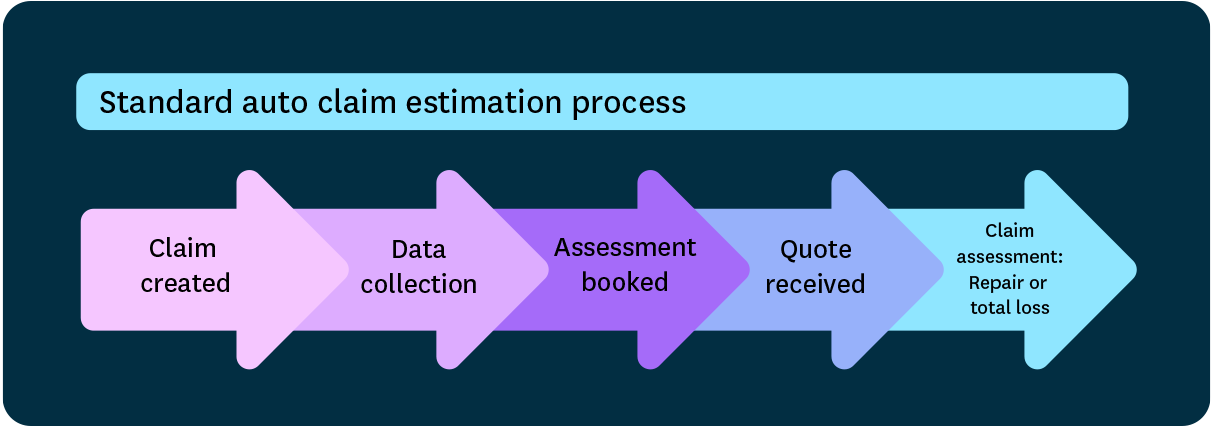

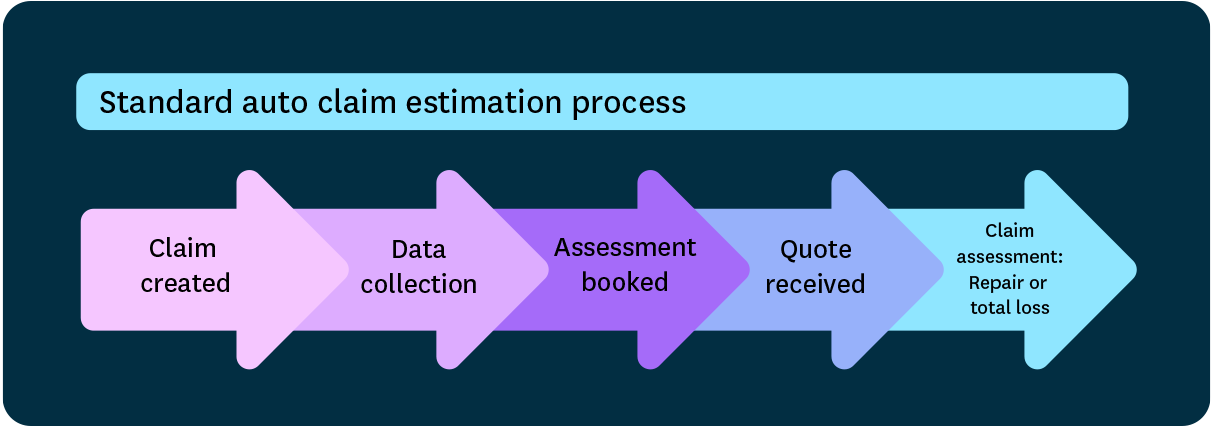

Following an accident, customers want support for their car repair or a quick notice of total loss. The process is daunting and confronting, and can take weeks to conclude in some cases. Many insurance companies produce very low levels of customer satisfaction following the protracted auto claims management process, which in turn causes customer churn.

There are many factors challenging the provision of consistent, accurate and informed estimates on vehicle repair costs, including low levels of automation and lack of availability of car parts data.

Reducing the time to quote

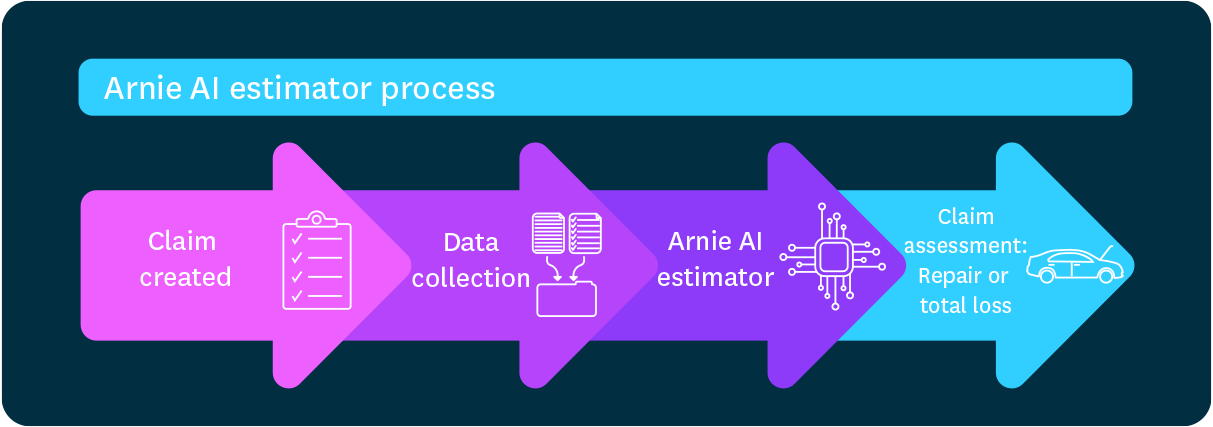

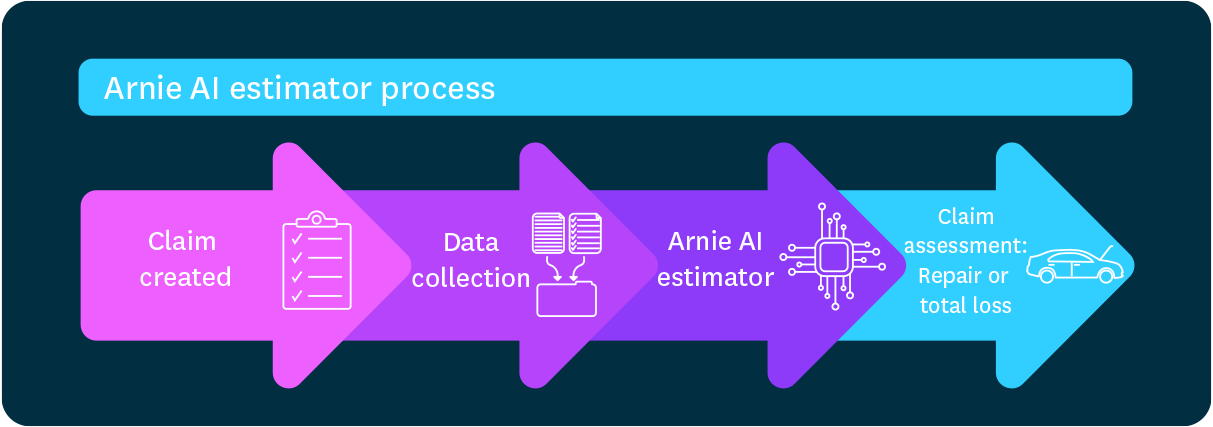

Arnie auto claims management software attempts to tackle this problem. Arnie’s\ AI Repair Estimator is driven by artificial intelligence to automate part of a motor claims vehicle assessment that currently demands excessive time and administrative effort for an accurate estimate of repairs or claim outcome.

Arnie’s new module reduces the number of days to receive a quote for repairs from the first notice of loss, offering best value for money on repairs completed to industry or manufacturer standard. Using scientific and historical data to inform decisions, save time, manual effort and reduce the possibility of human error or unknowns, Arnie transforms the way repairs are estimated with AI.

Estimates vary when left to manual processing, due to:

- Incorrect assessment on repair cost or total loss based on current market value

- Limited exposure to current list pricing for parts, paint or labour

- Insufficient details on a claim, such as images, documents and the accident description

- Variable experience and research

This costs insurers in the long-run, but also costs the insurance customer when claims costs are reportedly on the rise and insurance customer premiums are increased to compensate.

Insurers currently require quotes to be completed by repairers before they are able to complete the vehicle damage details. In just six months, an average of just over 50% of motor vehicle claims had the damage details completed. This means that almost half of motor vehicle claims do not have the necessary damage details to assess, classify and estimate the cost of repairs on a claim. This can result in creating additional follow-up and time delay for insurers and their customers before an assessment can be made. That’s where the Arnie AI Repair Estimator comes in.

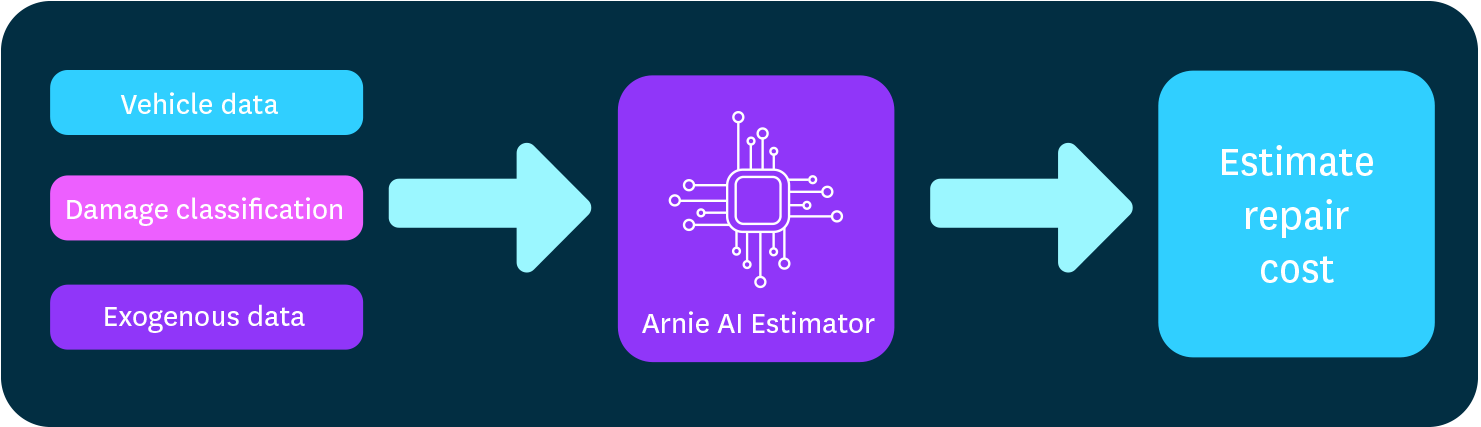

The Arnie AI Estimator

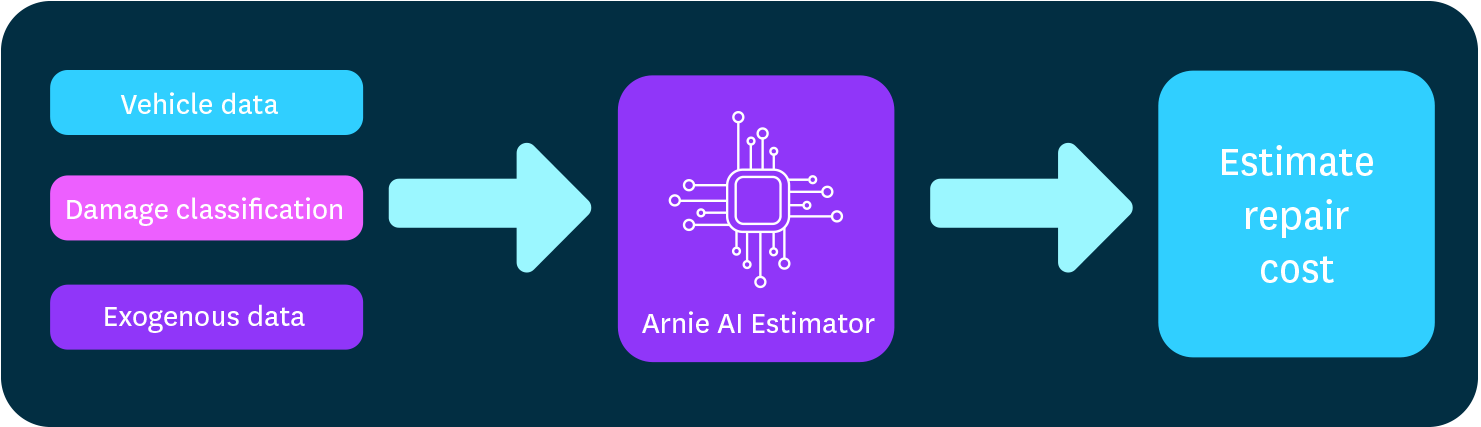

By working with key suppliers and thorough research, Arnie automatically identifies objects in images, including damage and identification numbers to identify patterns in large datasets and predict the cost of repairs, ultimately providing the claim outcome; repair or total loss. If the repair estimator deems damage to be repairable, it will even provide a recommendation on the most suitable repairer in accordance to the damage that needs to be repairer, including parts required, the make and model of the vehicle, location and repairer availability.

What does this mean for insurers?

Arnie significantly reduces the need for manual assessment when completing a simple, routine assessment, including the need to navigate and follow-up missing information to complete an assessment. Insurers then control their costs for not only assessments, but the cost of repairs, knowing the estimates are more accurate.

Insurance customers will also see a significant reduction in the time it takes for their vehicle to be ready for repair or deemed a total loss, following a real-time assessment and repair estimate at first notice of loss. This frees claims handlers and assessors to handle more complex scenarios requiring human intervention.

What does this mean for repairers?

Many workshops are now part of an insurer’s approved network, and their performance is evaluated against a range of criteria, with the most common metrics relating to cost, productivity and quality.

Insurance companies evaluate workshop performance by:

- The average cost per repair

- Vehicle turnaround time

- A quality score for all repair work undertaken

- The percentage of jobs requiring rectification

- A customer recommendation score

- Other or no formal measures of measurement

Improved repair estimates from the early stages of a claim effectively manage insurers and the customers’ expectations, providing relevant information to the workshop on the repairs to reduce turnaround time.

The Arnie AI Repair Estimator uses artificial intelligence to improve the consistency and accuracy of repair estimates, reducing the time it takes to manually assess a vehicle and significantly reducing the variables of a manual assessment to provide more accurate costs for the right claim outcome right at the start of first notice of loss.

Artificial intelligence in auto claims management- Arnie AI Repair Estimator

Ready for intelligent repair estimation?

The challenge

Following an accident, customers want support for their car repair or a quick notice of total loss. The process is daunting and confronting, and can take weeks to conclude in some cases. Many insurance companies produce very low levels of customer satisfaction following the protracted auto claims management process, which in turn causes customer churn.

There are many factors challenging the provision of consistent, accurate and informed estimates on vehicle repair costs, including low levels of automation and lack of availability of car parts data.

Reducing the time to quote

Arnie auto claims management software attempts to tackle this problem. Arnie’s\ AI Repair Estimator is driven by artificial intelligence to automate part of a motor claims vehicle assessment that currently demands excessive time and administrative effort for an accurate estimate of repairs or claim outcome.

Arnie’s new module reduces the number of days to receive a quote for repairs from the first notice of loss, offering best value for money on repairs completed to industry or manufacturer standard. Using scientific and historical data to inform decisions, save time, manual effort and reduce the possibility of human error or unknowns, Arnie transforms the way repairs are estimated with AI.

Estimates vary when left to manual processing, due to:

- Incorrect assessment on repair cost or total loss based on current market value

- Limited exposure to current list pricing for parts, paint or labour

- Insufficient details on a claim, such as images, documents and the accident description

- Variable experience and research

This costs insurers in the long-run, but also costs the insurance customer when claims costs are reportedly on the rise and insurance customer premiums are increased to compensate.

Insurers currently require quotes to be completed by repairers before they are able to complete the vehicle damage details. In just six months, an average of just over 50% of motor vehicle claims had the damage details completed. This means that almost half of motor vehicle claims do not have the necessary damage details to assess, classify and estimate the cost of repairs on a claim. This can result in creating additional follow-up and time delay for insurers and their customers before an assessment can be made. That’s where the Arnie AI Repair Estimator comes in.

The Arnie AI Estimator

By working with key suppliers and thorough research, Arnie automatically identifies objects in images, including damage and identification numbers to identify patterns in large datasets and predict the cost of repairs, ultimately providing the claim outcome; repair or total loss. If the repair estimator deems damage to be repairable, it will even provide a recommendation on the most suitable repairer in accordance to the damage that needs to be repairer, including parts required, the make and model of the vehicle, location and repairer availability.

What does this mean for insurers?

Arnie significantly reduces the need for manual assessment when completing a simple, routine assessment, including the need to navigate and follow-up missing information to complete an assessment. Insurers then control their costs for not only assessments, but the cost of repairs, knowing the estimates are more accurate.

Insurance customers will also see a significant reduction in the time it takes for their vehicle to be ready for repair or deemed a total loss, following a real-time assessment and repair estimate at first notice of loss. This frees claims handlers and assessors to handle more complex scenarios requiring human intervention.

What does this mean for repairers?

Many workshops are now part of an insurer’s approved network, and their performance is evaluated against a range of criteria, with the most common metrics relating to cost, productivity and quality.

Insurance companies evaluate workshop performance by:

- The average cost per repair

- Vehicle turnaround time

- A quality score for all repair work undertaken

- The percentage of jobs requiring rectification

- A customer recommendation score

- Other or no formal measures of measurement

Improved repair estimates from the early stages of a claim effectively manage insurers and the customers’ expectations, providing relevant information to the workshop on the repairs to reduce turnaround time.

The Arnie AI Repair Estimator uses artificial intelligence to improve the consistency and accuracy of repair estimates, reducing the time it takes to manually assess a vehicle and significantly reducing the variables of a manual assessment to provide more accurate costs for the right claim outcome right at the start of first notice of loss.