Data analytics, reporting and compliance

Make better, data-driven business decisions

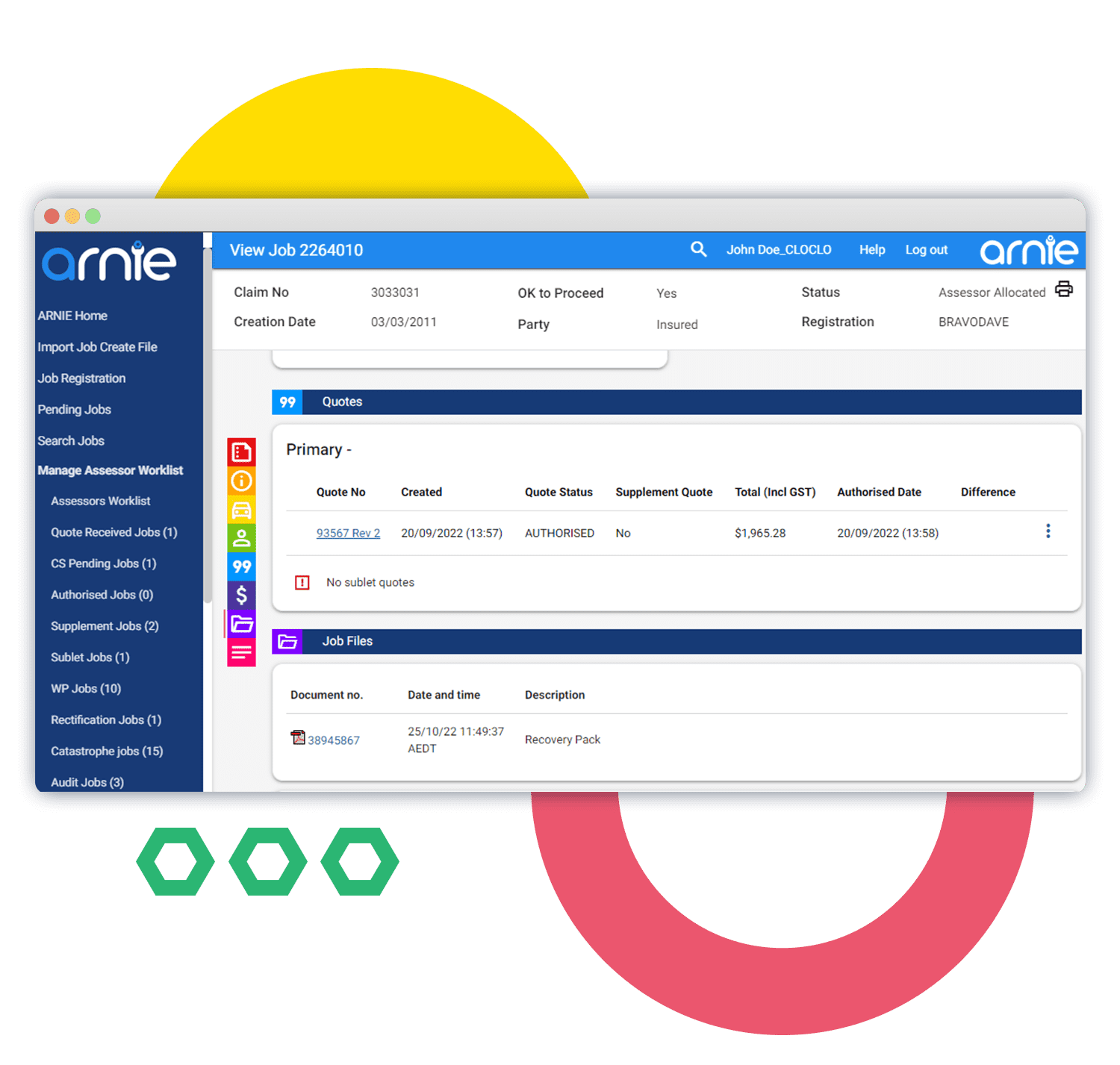

Motor vehicle insurers need cost-effective, efficient and intuitive solutions for managing their complex operations. With Arnie’s Business Intelligence capabilities and reporting tools, making strategic decisions is much simpler and backed by powerful data and predictive analytics.

Motor insurance industry reporting

Accurate data for powerful insights

Knowledge without visibility and access is useless. Arnie gathers and stores every piece of data – from vehicle details and industry pricing to staff productivity – in one user-friendly repository.

Make data driven tactical and strategic business decisions using Arnie’s robust reporting capabilities. Gain insights into performance and productivity across your organization and vendors. Supercharge compliance management and auditing with real-time accurate data.

Arnie offers reporting to suit your business needs; from standard reports, to custom and complex datasets for BI analysis.

Revolutionize your processes, empower claims staff and generate powerful insights to reshape customer satisfaction.

On demand reporting

Access quality data any time, anywhere

No more chasing down claims staff, assessors or repairers for the information you need. Access complete, high quality operational data anytime on Arnie and utilize it to drive down the average time and cost per claim, improve performance and enhance the customer experience.

Create operational or financial reports. Report on jobs by zone, by assessor, summaries, average fees by category, fee estimates vs fees paid and more. All reports can be represented by graphs, tables and crosstabs and includes the ability for simple calculations.

Compare providers and access industry pricing data. Quickly report on key variables, including expenditures and provider and staff productivity. Everything you need is right here.

Control costs

Prevent surprise invoices

The Arnie AI Repair Estimator uses artificial intelligence to improve the consistency and accuracy of repair estimates. Arnie requests repair shops provide quotes and estimated turnaround times before work approval can be issued. Bills that don’t match approved estimates won’t be paid.

Save on repair costs with Arnie’s automated benchmarking of parts prices. The system’s access to industry data, such as car insurance analytics, parts pricing, labor costs for similar repairs and vehicle valuations, eliminates time-consuming manual searches and invoice padding.

Leverage insurance predictive modeling to improve risk management, pricing, underwriting, claims handling, fraud detection, and operational efficiency, leading to improved profitability and competitiveness.

Compliance management solution

Support compliance management processes

Australian insurers face an ever-growing list of compliance requirements, reporting demands and regulatory changes. Insurance company compliance has never been more important.

Arnie’s robust insurance compliance software solutions allow insurers to maintain accurate and timely data that facilitates correct regulatory compliance reports and ensures transparency and accountability.

Easily report on compliance status and adherence to legislated industry timelines. Real-time monitoring and alerting capabilities allow companies to proactively identify compliance issues or deviations from established thresholds, enabling timely intervention.

More accurate data related to motor vehicle claims including validating and verifying data inputs to ensure they are complete, accurate, and consistent, reduces errors and mitigates compliance risks.

Quality control and auditing

Make fair and reliable decisions

Arnie’s quality control features ensure accurate and complete data is entered into the claims processing system. Auditing processes maintain data consistency throughout the claims lifecycle which is crucial for making fair and reliable claim decisions.

Use Arnie’s business rules engine to identify high-risk estimates and invoices and reduce manual processing on others. Automated workflows eliminate duplicate and time intensive manual inputs.

Automated process steps are triggered as tasks are created. Email notifications keep key stakeholders in the loop throughout the process. Tasks are completed within the system so you always know what’s going on with every claim.

Repairer performance ratings indicate reliability, bolstering trust. Auditing processes identify workflow inefficiencies, enabling operational improvements. By reducing errors and fraud, companies cut costs and enhance profitability.

Take back control of your claims process

Business intelligence is done better with Arnie. Simplify your motor claims management processes, data analytics, reporting and regulatory compliance with software built from the ground up for motor vehicle insurers. Enquire today.