Artificial intelligence in motor claims

For car insurers of tomorrow

Artificial Intelligence (AI) in Arnie simulates human intelligence in claims management, enabling the automation of processes and more informed decision making. Reduce administration. Easily identify fraud, errors and inconsistencies.

Arnie AI Estimator

Sophisticated insurance estimating software

Insurers spend hundreds of thousands of dollars to prepare accurate estimates for vehicle repairs. Many insurers rely on manual processes for estimates, which are time-consuming and prone to human error. Assessing the extent of damage to a vehicle and determining the necessary repairs can be challenging.

Using machine learning tools, pricing data and other critical data, Arnie insurance estimating software offers intelligent estimates of repair costs for car insurance claims.

Arnie’s cloud-based platform drives insurer growth by significantly reducing the time and manual effort required to review and settle claims efficiently, while keeping key stakeholders informed and still managing operational and repair costs.

Standardized estimating practices

Improve consistency across regions and repairers

Insurers may have inconsistent estimating practices across different regions, departments, or individual estimators. This lack of standardisation can result in disparities in estimates and lead to customer dissatisfaction, disputes with repairers and contractors, and decreased profit margins.

Arnie’s AI algorithms enforce standardised estimating practices and guidelines, ensuring consistency and accuracy in estimates across different regions, departments, and estimators.

Data-driven decisions

Up-to-date industry information

Insurers may have limited access to accurate and up-to-date data on repair costs, parts pricing, and labor rates. Without comprehensive data sources, estimators may struggle to obtain accurate cost estimates for vehicle repairs.

AI algorithms analyze vast amounts of historical claims data, repair industry trends, and pricing information to provide insurers with data-driven insights into repair costs, parts pricing, and labor rates.

By leveraging this comprehensive data, estimators can generate accurate estimates from their mobile device, tailored to specific vehicles, regions, and repair scenarios.

Reducing the time to quote

Increase repair efficiency

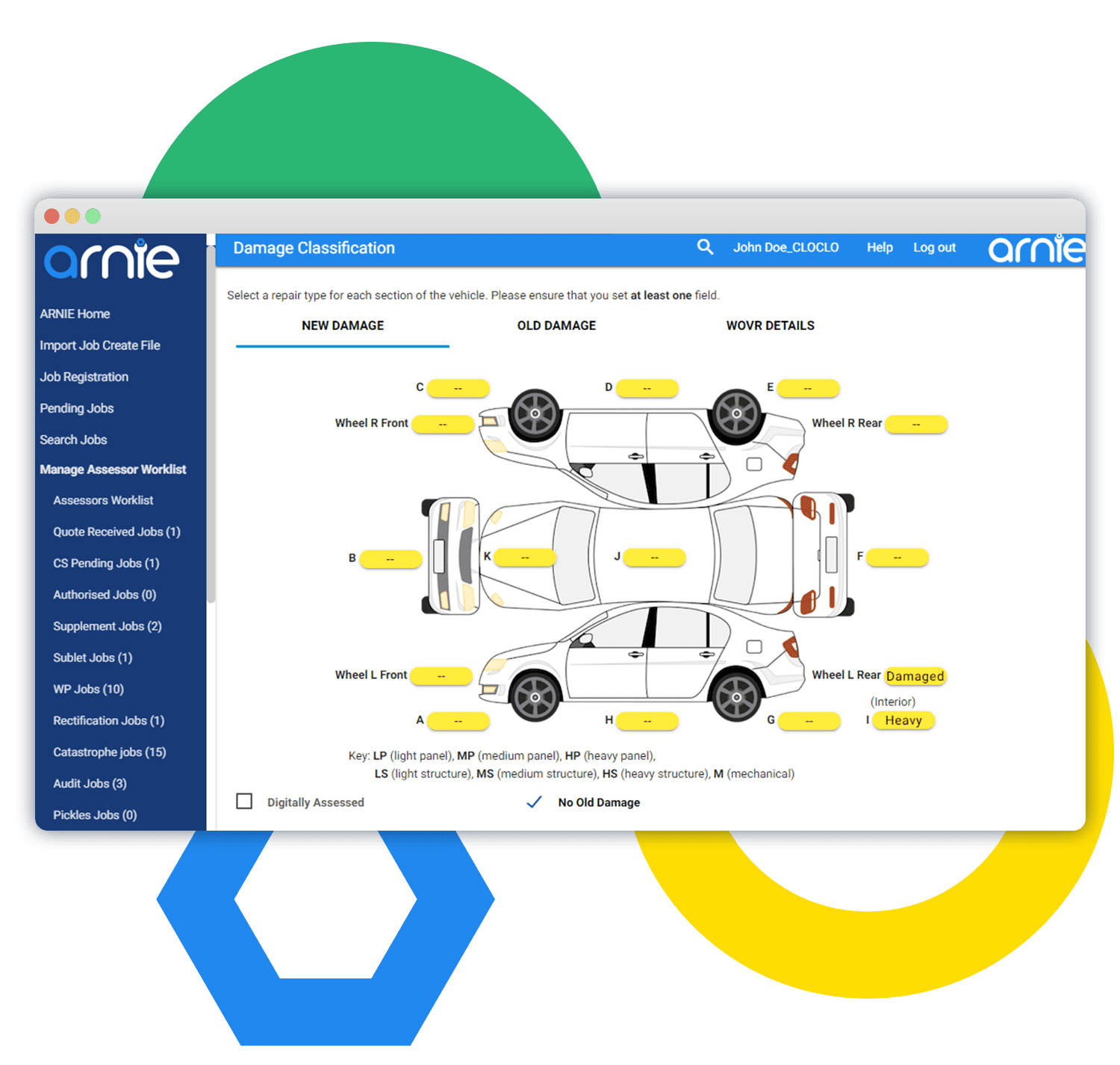

Arnie’s user-friendly AI Repair Estimator is driven by artificial intelligence to automate part of a motor claims vehicle assessment that currently demands excessive time and administrative effort for an accurate estimate of repairs or claim outcome.

Arnie’s new module increases efficiency of the entire repair process by reducing the number of days to receive a quote for repairs from the first notice of loss, offering best value for money on repairs completed to industry or manufacturer standard.

Using scientific and historical data to inform decisions, save time, manual effort and reduce the possibility of human error or unknowns, Arnie transforms the way repairs are estimated with AI.

Predictive analytics

Obtain more accurate forecasts

Repair costs can vary widely depending on factors such as the type of vehicle, location, severity of damage, and availability of parts. Without access to localized data or pricing information, insurers may struggle to prepare accurate estimates that reflect the true cost of repairs.

AI-based estimating software uses predictive analytics to anticipate potential repair costs based on various factors such as vehicle type, damage severity, and repair complexity.

By forecasting repair costs with greater accuracy, insurers can proactively manage claim reserves, minimize financial risk, and optimize claims outcomes.

Leverage artificial intelligence for efficiency and accuracy

Arnie’s AI-driven insurance estimating software represents a significant advancement in technology for car insurers, fast-tracking claims management with insights driven by machine learning and existing data. By harnessing the power of artificial intelligence, Arnie streamlines claims processing, reduces manual effort, and enhances accuracy in estimating repair costs.