Motor claims process management

End-to-end, cloud based insurance solution

Your ability to manage the claims process is essential to your success as an insurer. Controlling key variables to deliver a consistent result is vital to delivering a satisfactory outcome not just to policyholders, but to shareholders and other stakeholders.

Motor claims management software

Revolutionise your insurance claims process

Events such as human error, data duplication and double-handling affect your ability to deliver for your clients, creating ripple effects that negatively impact customer retention and the bottom line.

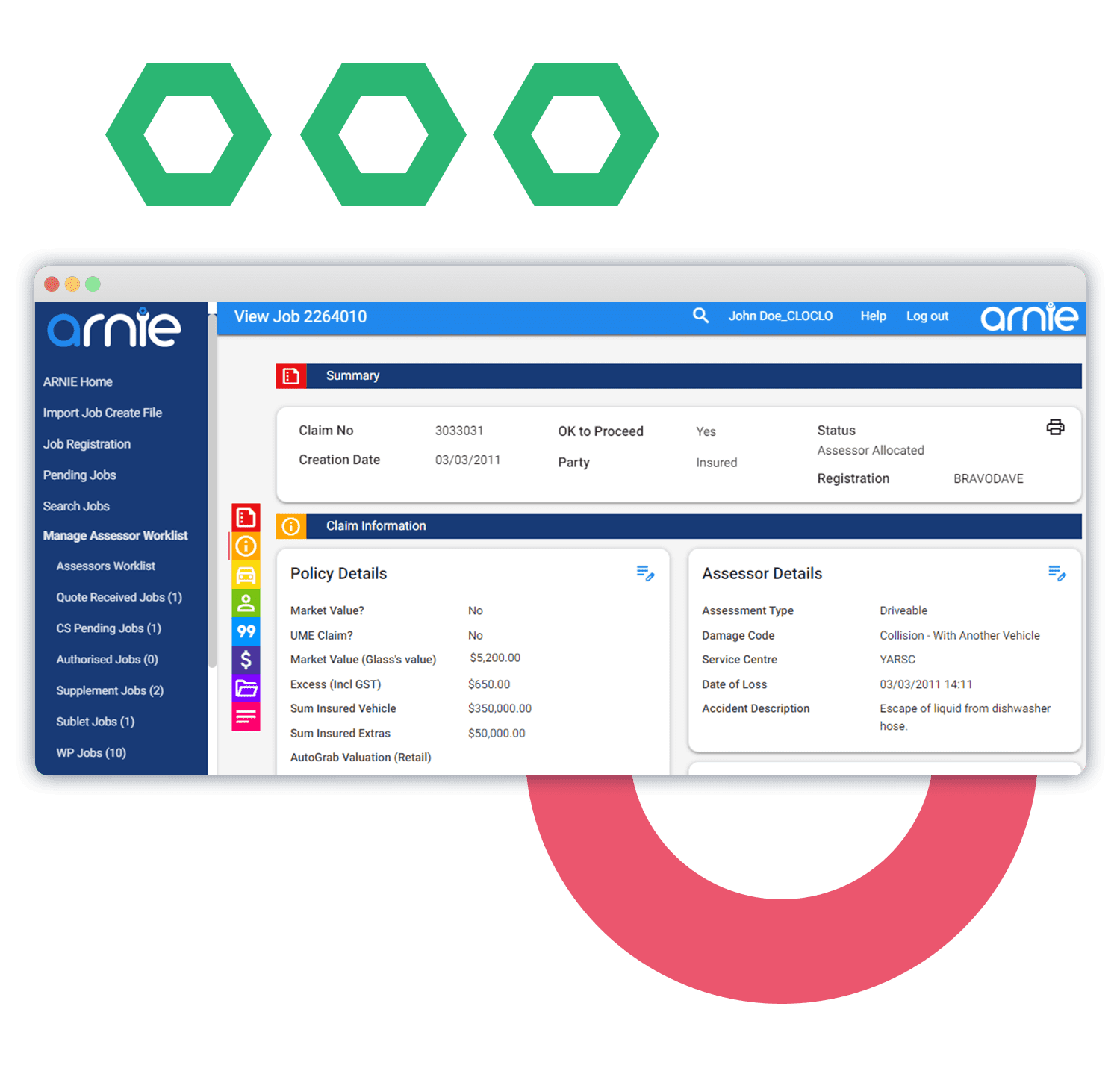

From claim lodgement to claim settlement, Arnie provides the visibility you need to act with confidence and minimize the chance of costly errors.

Our claims management solution is designed to revolutionize the entire motor insurance claims process. Arnie helps improve operational efficiency and staff performance at every stage, reducing confusion and delivering certainty for your clients.

Scalable solution for processing claims

A single point of truth

Insurers often struggle to scale their claims processing operations, especially during catastrophic events or peak times, leading to bottlenecks and resource constraints.

Having a scalable cloud based motor claims management solution enables insurers to adapt swiftly during major incidents and respond to evolving business needs and insurance industry trends.

Arnie supports businesses to work the way that best suits them. Staff can collaborate on individual claims in real time from multiple locations and multiple device types to deliver the best possible client outcomes.

A single point of truth and document management system for your organization, all relevant images and files are stored securely against the claim, making it easy to refer back to photographs of collision damage and reports and quotes from your repairers.

Reduce the cost of vehicle repairs

Shorten the repair life cycle

Managing a diverse range of claim types, each with its unique circumstances and requirements, can be inherently complex and time-consuming for insurers.

Vehicle claims management has historically been drawn out and expensive, leaving many customers frustrated by the lack of visibility into the process.

Arnie’s automated workflows, transparent repairer selection and at-a-glance status on claims, makes it easy to monitor claims, repairers and costs with ease, as well as identify opportunities to reduce claim costs.

Real time job tracking

Keep claims moving

Prevent customer complaints, strengthen relationships with your repairers and keep claims moving. Arnie’s job tracking capabilities, worklists and dashboards provide at-a-glance updates of claims in process and alert you to any that require attention.

Assessors and repairers complete tasks within the system, which updates automatically, so you’ll always have access to the most up-to-date information on a claim. Claims staff also have direct access to Arnie and can provide updates while the customer is still on the line.

Make better decisions

Loss versus repair calculator

Empower assessors and claims staff to make better decisions and manage claims more effectively with our motor insurance claims management system.

Arnie is a powerful ally for proactive risk management. By analyzing claims data, market trends, and external factors, insurers can gain a comprehensive understanding of their risk landscape, changing regulatory environments, or shifts in market dynamics, allowing for risk mitigation.

Robust data repository

Reduce costs and improve productivity

Extracting data from multiple systems, such as policy administration systems, claims databases, and third-party sources, is time-consuming and labor-intensive.

Arnie aggregates and analyses vast amounts of claims data, providing insurers with valuable insights into all aspects of the process.

Worklists provide visibility into insurance claim status and whether repairers’ are meeting their KPIs. All user actions are time and date stamped. Reporting on expenditure and staff productivity is comprehensive and can be analyzed in the finest detail.

Workload management

Be prepared for major events

During catastrophic events or busy periods, insurance claims management software can support workload management through features such as auto-allocation of claims based on predefined criteria, and workload balancing.

Features include; intelligent assessment booking tools, automated allocation of job and workload distribution, catastrophic event code management and outsourcing to third-party assessors by agreements and business rules.

Efficient insurance claims management from start to finish with Arnie

Effective auto claims process management is crucial for insurers striving to enhance customer satisfaction and operational efficiency.

Arnie revolutionizes claims management by offering a scalable platform that streamlines processes, reduces costs, and improves decision-making.