Redefining the future of motor claims: Balancing insurtech and customer experiences

Advancing technology doesn’t mean we sacrifice customer experience

The challenge

In the last financial year, Australian Financial Complaints Authority (AFCA) reported a staggering number of complaints from motor insurance customers, relating to the service of claims handling. Over 25% of complaints escalated to AFCA were for general insurance for motor claims. This is up to 2,000 unsatisfactory customer experiences!

AFCA highlights the top five contributing issues:

AFCA highlights the top five contributing issues:

- Inadequate claim amount

- Denial of claim due to exclusions or conditions

- Full denial of a claim

- A delay in the handling of a claim

- Poor service quality

At Arnie, we know the future of motor claims is accelerating fast, and with the right combination of technology and customer experience (CX), we see through our crystal ball these and other significant industry opportunities will evolve.

The future

Some requirements will never change, such as quality. Quality assurance for damage assessments, repairs and post-repair assessments are becoming more accessible, efficient and more consistent. Artificial intelligence is able to scientifically aggregate complex datasets to minimise the number of manual assessments required by motor assessors and repairers. In the near future we will see a significant rise in the number of claims processed that are no-touch, and as a result, a reduced number of complaints due to delays in claim handling and poor service quality. It’s not all robots and web chats; automation will be carefully articulated to meet the business and customer needs, balancing brand and reputation standards which are commonly communicated through conversation.

Impatient people are forced to be patient everyday, and this could not be more true when it comes to an insurance claim. To be award-winners in customer satisfaction, the future of claims will see insurers providing self-management tools for insurance customers that enable them to take a peek at the status of their claim, predict when they’ll get back on the road, and even keep them informed at the moments that matter without having to ask, creating efficiency honesty and fairness.

Fingers are on the pulse for a significant growth in Insurtech, Fintech and automotive technology as a wider industry. Car subscription services are on the rise, usage-based insurance products are preferred by many, with the pandemic changing the way we drive and own vehicles indefinitely, and with electric vehicle technology becoming more prevalent. Insurers, their claims teams and service providers will develop new ways of working together.

Our roadmap

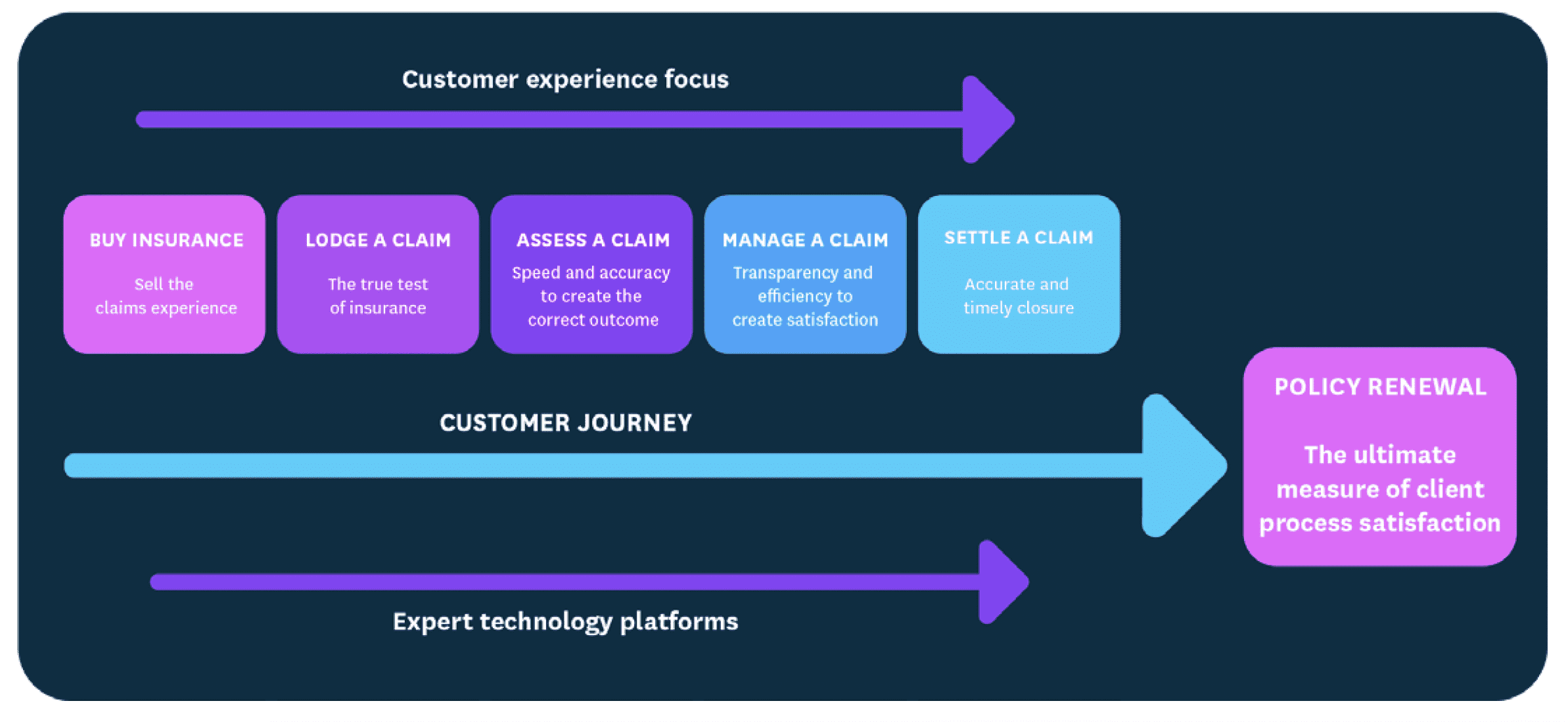

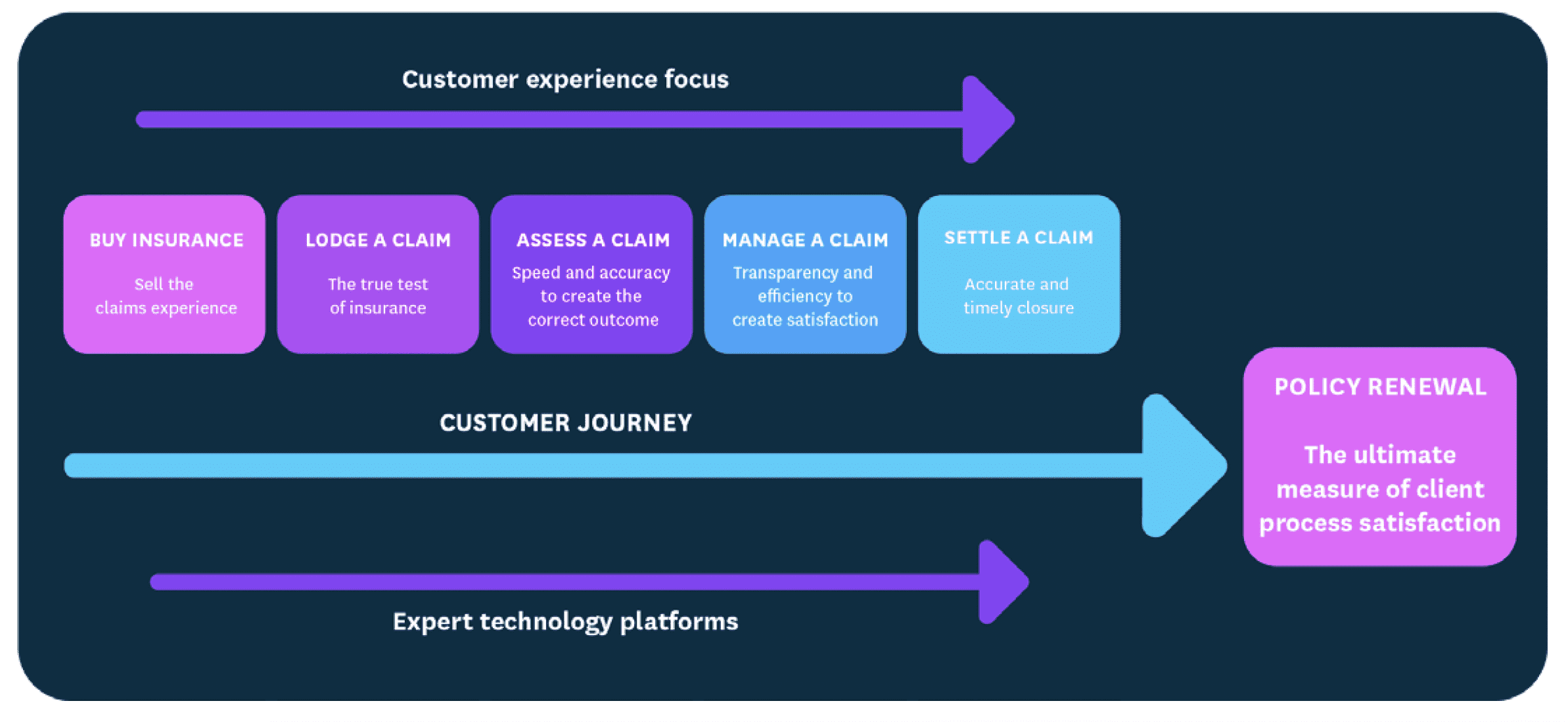

Arnie’s roadmap is paving the way for no speed restrictions or traffic control for our insurers and repairers. We recognize the opportunity to join the dots to flatten and reduce the curve on claim costs, including the time it takes to handle and settle a claim, which creates high insurance renewal retention rates following a positive claims experience, and builds insurer-repairer relationships.

Our roadmap focuses on key themes to shape the future of motor claims while holding onto the authenticity and power of an excellent customer experience. These themes include:

- Using predictive analytics to augment processes with artificial intelligence at first notice of loss, assessments and repairs, right through to the settlement of a claim, to the customer and reconciliation of claim costs for insurers and repairers

- Controlling the cost of a claim with industry benchmarking to better inform decision-making abilities

- Reinventing the way we inform insurance customers at the moments that matter

- Further automating processes to create operational efficiencies that free up humans for more complex claims handling and forward-thinking

- Optical character recognition (OCR) for detection of key data and automatic processing of information from external sources

At Yarris Technologies we pride ourselves on being people-focused, supported by robust security systems and protocols, industry knowledge and expertise to lead the change, and the experience of a long-standing SaaS company combined with the passion and innovation often seen in start-ups.

We’re electrified by sharing new technology and scalable solutions with our customers who are saving time and money, and in turn, delighting their customers.

What does this mean for insurers?

Insurers will be equipped with the best available information to benchmark the true cost of a claim and contain their costs whilst not skimping out on customer experiences, quality, compliance and security. Actuaries and Business Intelligence teams will have capabilities and insights to what has been some of the claims and repairs ‘black holes’.

The balancing act of technology vs customer experience will no longer require ‘circus tricks’, as system solutions are defined and refined to meet requirements and exceed customer expectations, leaving the claims handlers and repairers to solely focus on the human interaction when it matters.

What does this mean for repairers?

Australia is heading towards a streamlined, regulated method of operations between insurers and repairers. For many decades, disconnected governing bodies complicated the need for customers to be treated fairly and consistently, no matter the insurance company, or the state.

Some insurance companies are leading the way on how they expect their customers to be treated, utilizing company-owned repair shops to deliver outstanding customer experience throughout the repair process, while achieving cost containment.

For independent repairers to excel moving forward, there needs to be a complete mind shift by insurers and repairers, to create an environment of mutual trust and respect. This is the only way for the customer to be the winner and to build a sustainable industry.

This requires the repairer to adopt industry leading systems and processes to integrate with the insurer and assist them to run the shop. These systems enable the repairer to effectively manage their workflow, process and quality, and drive efficiency in the workshop enabling the shop to become more profitable. In turn this enables the repairer to invest in their staff and capital equipment.

What does this mean for insurance customers?

Insurance customers will have the ability to lodge their own claim in the palm of their hand. They’ll be able to retrieve and receive real-time updates that won’t even allow the thought, ‘I wonder how my car insurance claim is going’ to surface.

Insurance customers will see vastly reduced timeframes from their first notice of loss to key return. They’ll be ecstatic with their simple and successful claims experiences, and they’ll be telling their family and friends about their insurance company’s new process. It’s also likely that the happy customer will remain a long-term, loyal customer for many renewal periods to come.

A quick recap of the facts

- Over 25% of complaints received by AFCA last financial year for general insurance were motor vehicle claims

- Claim handling time and service quality are two of the top five issues when it comes to insurance complaints raised and escalated to AFCA

A successful future for motor claims has equal space for human interaction and software solutions and technology. To combat known issues, bring clarity to uncertainty and be prepared for what is likely to come, it’s time to work with partners who understand that there’s a balance needed between the two for greatest growth and retention of your customers and providers.

Redefining the future of motor claims: Balancing insurtech and customer experiences

Advancing technology doesn’t mean we sacrifice customer experience

The challenge

In the last financial year, Australian Financial Complaints Authority (AFCA) reported a staggering number of complaints from motor insurance customers, relating to the service of claims handling. Over 25% of complaints escalated to AFCA were for general insurance for motor claims. This is up to 2,000 unsatisfactory customer experiences!

AFCA highlights the top five contributing issues:

AFCA highlights the top five contributing issues:

- Inadequate claim amount

- Denial of claim due to exclusions or conditions

- Full denial of a claim

- A delay in the handling of a claim

- Poor service quality

At Arnie, we know the future of motor claims is accelerating fast, and with the right combination of technology and customer experience (CX), we see through our crystal ball these and other significant industry opportunities will evolve.

The future

Some requirements will never change, such as quality. Quality assurance for damage assessments, repairs and post-repair assessments are becoming more accessible, efficient and more consistent. Artificial intelligence is able to scientifically aggregate complex datasets to minimise the number of manual assessments required by motor assessors and repairers. In the near future we will see a significant rise in the number of claims processed that are no-touch, and as a result, a reduced number of complaints due to delays in claim handling and poor service quality. It’s not all robots and web chats; automation will be carefully articulated to meet the business and customer needs, balancing brand and reputation standards which are commonly communicated through conversation.

Impatient people are forced to be patient everyday, and this could not be more true when it comes to an insurance claim. To be award-winners in customer satisfaction, the future of claims will see insurers providing self-management tools for insurance customers that enable them to take a peek at the status of their claim, predict when they’ll get back on the road, and even keep them informed at the moments that matter without having to ask, creating efficiency honesty and fairness.

Fingers are on the pulse for a significant growth in Insurtech, Fintech and automotive technology as a wider industry. Car subscription services are on the rise, usage-based insurance products are preferred by many, with the pandemic changing the way we drive and own vehicles indefinitely, and with electric vehicle technology becoming more prevalent. Insurers, their claims teams and service providers will develop new ways of working together.

Our roadmap

Arnie’s roadmap is paving the way for no speed restrictions or traffic control for our insurers and repairers. We recognize the opportunity to join the dots to flatten and reduce the curve on claim costs, including the time it takes to handle and settle a claim, which creates high insurance renewal retention rates following a positive claims experience, and builds insurer-repairer relationships.

Our roadmap focuses on key themes to shape the future of motor claims while holding onto the authenticity and power of an excellent customer experience. These themes include:

- Using predictive analytics to augment processes with artificial intelligence at first notice of loss, assessments and repairs, right through to the settlement of a claim, to the customer and reconciliation of claim costs for insurers and repairers

- Controlling the cost of a claim with industry benchmarking to better inform decision-making abilities

- Reinventing the way we inform insurance customers at the moments that matter

- Further automating processes to create operational efficiencies that free up humans for more complex claims handling and forward-thinking

- Optical character recognition (OCR) for detection of key data and automatic processing of information from external sources

At Yarris Technologies we pride ourselves on being people-focused, supported by robust security systems and protocols, industry knowledge and expertise to lead the change, and the experience of a long-standing SaaS company combined with the passion and innovation often seen in start-ups.

We’re electrified by sharing new technology and scalable solutions with our customers who are saving time and money, and in turn, delighting their customers.

What does this mean for insurers?

Insurers will be equipped with the best available information to benchmark the true cost of a claim and contain their costs whilst not skimping out on customer experiences, quality, compliance and security. Actuaries and Business Intelligence teams will have capabilities and insights to what has been some of the claims and repairs ‘black holes’.

The balancing act of technology vs customer experience will no longer require ‘circus tricks’, as system solutions are defined and refined to meet requirements and exceed customer expectations, leaving the claims handlers and repairers to solely focus on the human interaction when it matters.

What does this mean for repairers?

Australia is heading towards a streamlined, regulated method of operations between insurers and repairers. For many decades, disconnected governing bodies complicated the need for customers to be treated fairly and consistently, no matter the insurance company, or the state.

Some insurance companies are leading the way on how they expect their customers to be treated, utilizing company-owned repair shops to deliver outstanding customer experience throughout the repair process, while achieving cost containment.

For independent repairers to excel moving forward, there needs to be a complete mind shift by insurers and repairers, to create an environment of mutual trust and respect. This is the only way for the customer to be the winner and to build a sustainable industry.

This requires the repairer to adopt industry leading systems and processes to integrate with the insurer and assist them to run the shop. These systems enable the repairer to effectively manage their workflow, process and quality, and drive efficiency in the workshop enabling the shop to become more profitable. In turn this enables the repairer to invest in their staff and capital equipment.

What does this mean for insurance customers?

Insurance customers will have the ability to lodge their own claim in the palm of their hand. They’ll be able to retrieve and receive real-time updates that won’t even allow the thought, ‘I wonder how my car insurance claim is going’ to surface.

Insurance customers will see vastly reduced timeframes from their first notice of loss to key return. They’ll be ecstatic with their simple and successful claims experiences, and they’ll be telling their family and friends about their insurance company’s new process. It’s also likely that the happy customer will remain a long-term, loyal customer for many renewal periods to come.

A quick recap of the facts

- Over 25% of complaints received by AFCA last financial year for general insurance were motor vehicle claims

- Claim handling time and service quality are two of the top five issues when it comes to insurance complaints raised and escalated to AFCA

A successful future for motor claims has equal space for human interaction and software solutions and technology. To combat known issues, bring clarity to uncertainty and be prepared for what is likely to come, it’s time to work with partners who understand that there’s a balance needed between the two for greatest growth and retention of your customers and providers.