Arnie auto claims software integrations transform customer satisfaction

By Danni Robson

Head of Product

Arnie auto claims software integrations transform customer satisfaction

Customers expect real-time support at the touch of a button when they experience an accident. If they don’t experience a supportive, efficient, timely and positive outcome, they vote with their feet, and the result is customer churn.

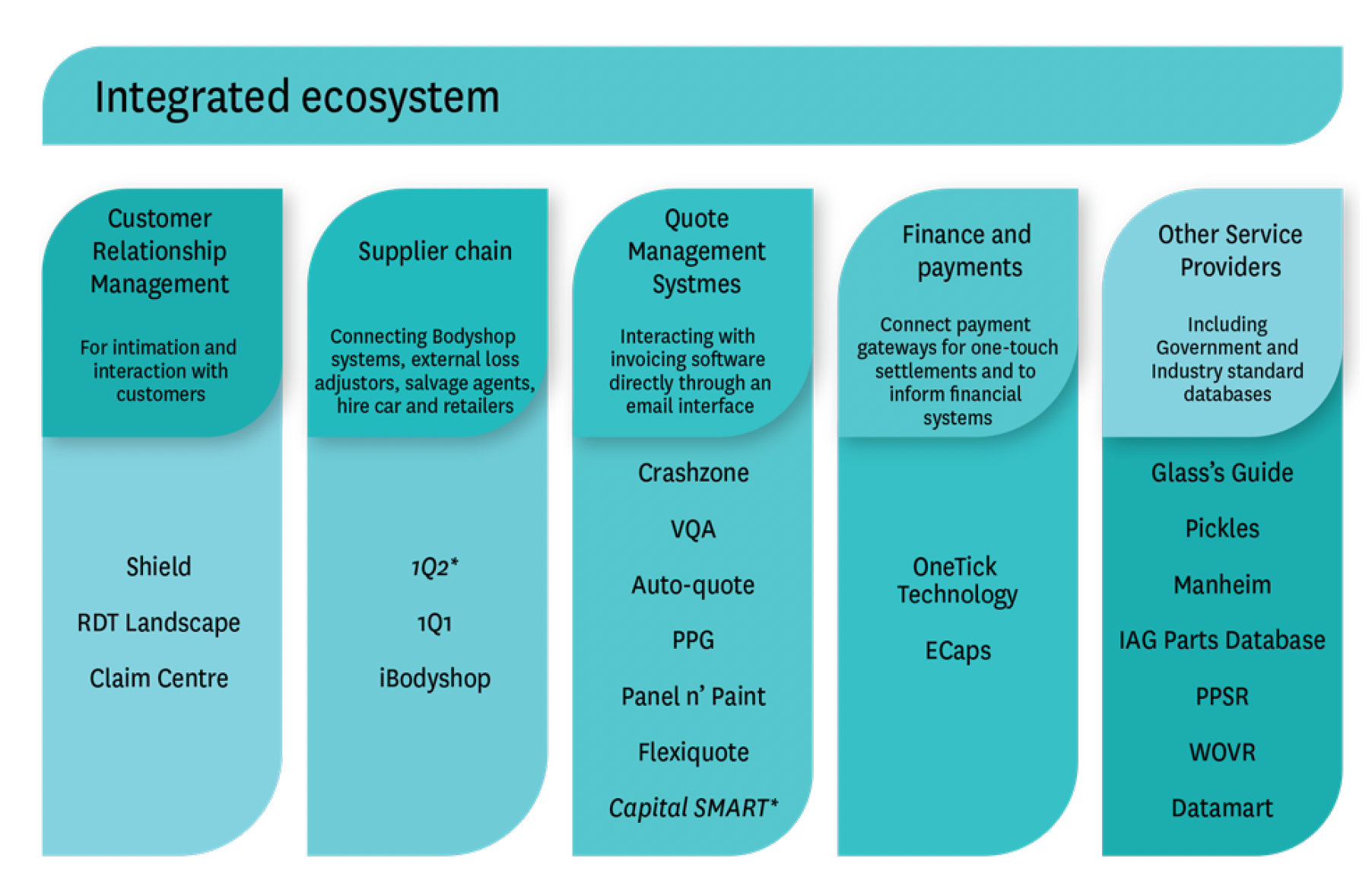

To retain customers and ensure an efficient and cost-effective process, a range of service providers need to come together to provide integrated services that focus on the customer outcomes. Arnie motor claims management system brings all of the key players in the auto claims management process in a cloud-based, centralized platform.

The industry has rich data available from each of the parties in motor vehicle claim handling throughout the end-to-end process that contributes to the digital transformation of the auto claims management process and the emergence of new ways to manage claims efficiently, cost-effectively and with a focus on the customer experience. Arnie manages tens of thousands of claims per month with hundreds of thousands of interface messages to and from Arnie and the key players on the platform.

Integration is Arnie’s greatest strength as we continue to enhance the information available to insurers in Arnie. By automating and integrating solutions to solve the motor claims industry’s most complex problems, we reduce the time it takes for a customer to resolve their motor claims, and increase operational and cost efficiencies without sacrificing service and customer satisfaction for our insurers.

1. One-system, single-user access

Arnie auto claims management system integrates service providers and software packages such as:

- Insurers’ policy systems (Shield, RDT Landscape, Claim Center)

- Assessors and repairers (1Q1, 1Q2, iBodyshop)

- Salvage agents (Pickles/Manheim, WOVR)

- Industry parts lists (IAG)

- Vehicle valuation guides (Glass’ Guide)

- Quote system (Crashzone, VQA, Auto-Quote, PPG, Panel n Paint, Flexiquote)

- Invoicing systems (ECaps)

- Finance systems. (Onetick)

Each interface integration saves a claims handler or specialist a manual, time-consuming procedure to enable the investment of time in solving more complex claims requiring human interaction instead.

This is particularly important for insurance assessors, who are often on-the-road, and switching between multiple software systems to find the relevant information to manage an auto insurance claims or assessment at the required time.

2. Real-time automated updates to customers

Many of us have waited on hold while an insurance company scans their systems for conflicting information to provide us with a simple status update we could have received electronically. An effective system could have saved time, effort and improved the overall experience. Real-time updates keep customers informed, help them make decisions and enable them to react appropriately to the next required steps, while reducing calls to the call center.

3. Data mining capabilities for improved business intelligence and reporting

Data analysis and reporting on auto claims management can feel like panning for gold with an open sieve. How do you find out the trends? Repair durations? Methods of repair? Parts pricing? Business intelligence and advanced integration leverage Arnie platform data so assessors and managers see a more realistic picture of potential problems in time to reduce or eliminate them.

4. A competitive advantage for businesses prioritising digital transformation

According to a recent survey [Statista, 2021], digital transformation is the leading priority for information technology initiatives for global companies in 2021. Other priorities include cybersecurity and strategic cloud migration.

A large number of organisations who identified the need for a digital transformation focus are still investigating the opportunity and understanding the risk versus the reward. Digital transformation in the insurance industry:

- reduces claim durations

- reduces the cost of claims

- creates transparency into the process

- improves efficiencies

- boosts customer satisfaction

5. Reduced operational costs

The insurance motor claims industry is not an industry where growth is the main focus. Finding operational efficiencies and other cost-saving opportunities are the highest areas of opportunity for revenue for insurers. By optimizing business performance and efficiencies through reducing the number of human-touch points where integration and automation may solve simple problems, businesses can save time and productivity to invest in more complex claims handling where human interaction makes moments that matter.

Arnie auto claims software integrations transform customer satisfaction

By Danni Robson

Head of Product

Arnie auto claims software integrations transform customer satisfaction

Customers expect real-time support at the touch of a button when they experience an accident. If they don’t experience a supportive, efficient, timely and positive outcome, they vote with their feet, and the result is customer churn.

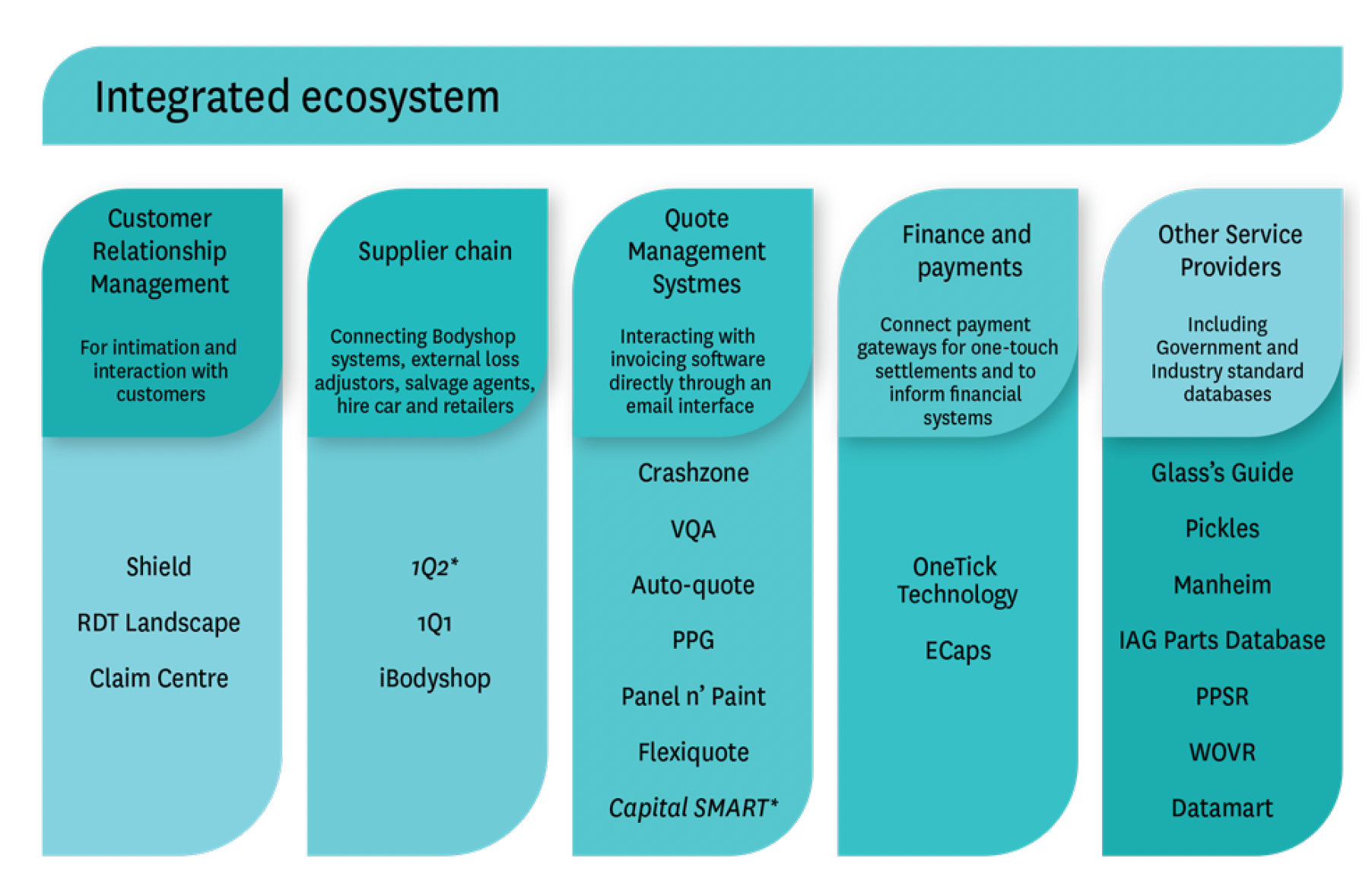

To retain customers and ensure an efficient and cost-effective process, a range of service providers need to come together to provide integrated services that focus on the customer outcomes. Arnie motor claims management system brings all of the key players in the auto claims management process in a cloud-based, centralized platform.

The industry has rich data available from each of the parties in motor vehicle claim handling throughout the end-to-end process that contributes to the digital transformation of the auto claims management process and the emergence of new ways to manage claims efficiently, cost-effectively and with a focus on the customer experience. Arnie manages tens of thousands of claims per month with hundreds of thousands of interface messages to and from Arnie and the key players on the platform.

Integration is Arnie’s greatest strength as we continue to enhance the information available to insurers in Arnie. By automating and integrating solutions to solve the motor claims industry’s most complex problems, we reduce the time it takes for a customer to resolve their motor claims, and increase operational and cost efficiencies without sacrificing service and customer satisfaction for our insurers.

1. One-system, single-user access

Arnie auto claims management system integrates service providers and software packages such as:

- Insurers’ policy systems (Shield, RDT Landscape, Claim Center)

- Assessors and repairers (1Q1, 1Q2, iBodyshop)

- Salvage agents (Pickles/Manheim, WOVR)

- Industry parts lists (IAG)

- Vehicle valuation guides (Glass’ Guide)

- Quote system (Crashzone, VQA, Auto-Quote, PPG, Panel n Paint, Flexiquote)

- Invoicing systems (ECaps)

- Finance systems. (Onetick)

Each interface integration saves a claims handler or specialist a manual, time-consuming procedure to enable the investment of time in solving more complex claims requiring human interaction instead.

This is particularly important for insurance assessors, who are often on-the-road, and switching between multiple software systems to find the relevant information to manage an auto insurance claims or assessment at the required time.

2. Real-time automated updates to customers

Many of us have waited on hold while an insurance company scans their systems for conflicting information to provide us with a simple status update we could have received electronically. An effective system could have saved time, effort and improved the overall experience. Real-time updates keep customers informed, help them make decisions and enable them to react appropriately to the next required steps, while reducing calls to the call center.

3. Data mining capabilities for improved business intelligence and reporting

Data analysis and reporting on auto claims management can feel like panning for gold with an open sieve. How do you find out the trends? Repair durations? Methods of repair? Parts pricing? Business intelligence and advanced integration leverage Arnie platform data so assessors and managers see a more realistic picture of potential problems in time to reduce or eliminate them.

4. A competitive advantage for businesses prioritising digital transformation

According to a recent survey [Statista, 2021], digital transformation is the leading priority for information technology initiatives for global companies in 2021. Other priorities include cybersecurity and strategic cloud migration.

A large number of organisations who identified the need for a digital transformation focus are still investigating the opportunity and understanding the risk versus the reward. Digital transformation in the insurance industry:

- reduces claim durations

- reduces the cost of claims

- creates transparency into the process

- improves efficiencies

- boosts customer satisfaction

5. Reduced operational costs

The insurance motor claims industry is not an industry where growth is the main focus. Finding operational efficiencies and other cost-saving opportunities are the highest areas of opportunity for revenue for insurers. By optimizing business performance and efficiencies through reducing the number of human-touch points where integration and automation may solve simple problems, businesses can save time and productivity to invest in more complex claims handling where human interaction makes moments that matter.