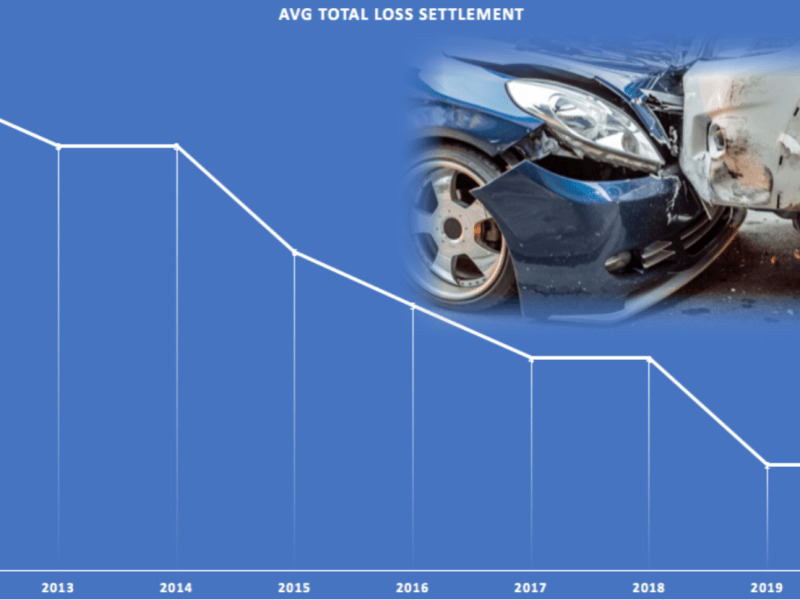

Driving down the average total loss settlement to less than 2.5 days

With Arnie’s inbuilt smart algorithms and automations, the average total loss claim settlement now takes less than 2.5 days, down from 9 days in 2012. With just a few clicks, Arnie extracts information on vehicle encumbrance, write off details, theft or stolen information and notifies the customer and salvage agents for disposal.

Declaring a car as a ‘Total Loss’ is different to other insurance claims. This process requires more effort on the part of insured, and demands a robust communication process between the insurance company and the customers to enhance the customer experience during a stressful time.

Arnie automatically determines if the cost to repair the damage to the car is more than it is ‘worth’. Arnie uses Total Loss Formula (TLF), where the sum of the cost of repairs plus the salvage value of car exceeds the car actual value. This rapid response enhances the customer’s desire for a quick resolution, and reduces the cost of hire cars to the insurance company.

Arnie average total loss settlement timeline

Arnie’s automation capability drives rapid total loss settlements. By automating the exchange of information and the control of activities across all parties – including customers, repairers, tow yards and salvage agents – the Arnie motor claims management platform enables insurers to significantly enhance the customer experience, and to reduce the total loss claim period from end-to-end.